Featured Events

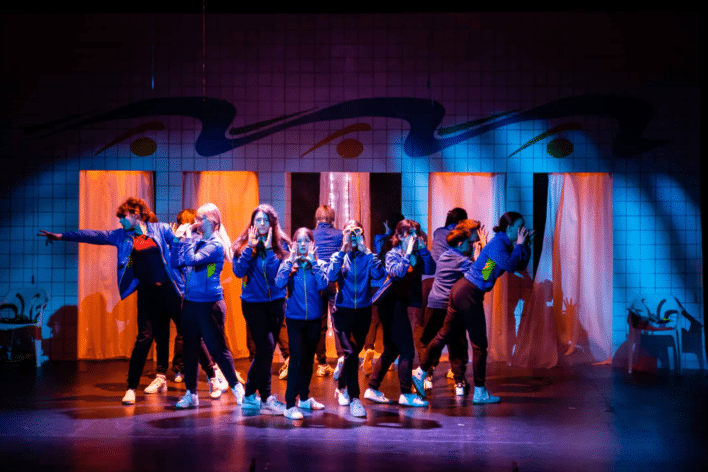

Front Row Fashion Show

Alasdair Beckett-King: Nevermore

Or choose a genre:

Accessibility at Theatre Royal

Everyone is welcome at Theatre Royal Bury St Edmunds and we provide a wide range of support and services to ensure you have an enjoyable and comfortable visit.

Find out moreSupport us

Donate now

Whatever the amount of the donation, it is support that we didn’t have until you gave it.

Donate here

Give the gift of theatre

Make someone’s day with a night out at the theatre. Spoil your friends and family and let them decide what to see with their gift.

Buy a gift voucherHave a question?

Contact us!The fields marked with * are required.

Sign up to our newsletter

Join our mailing list to find out more about Theatre Royal. Account

Account